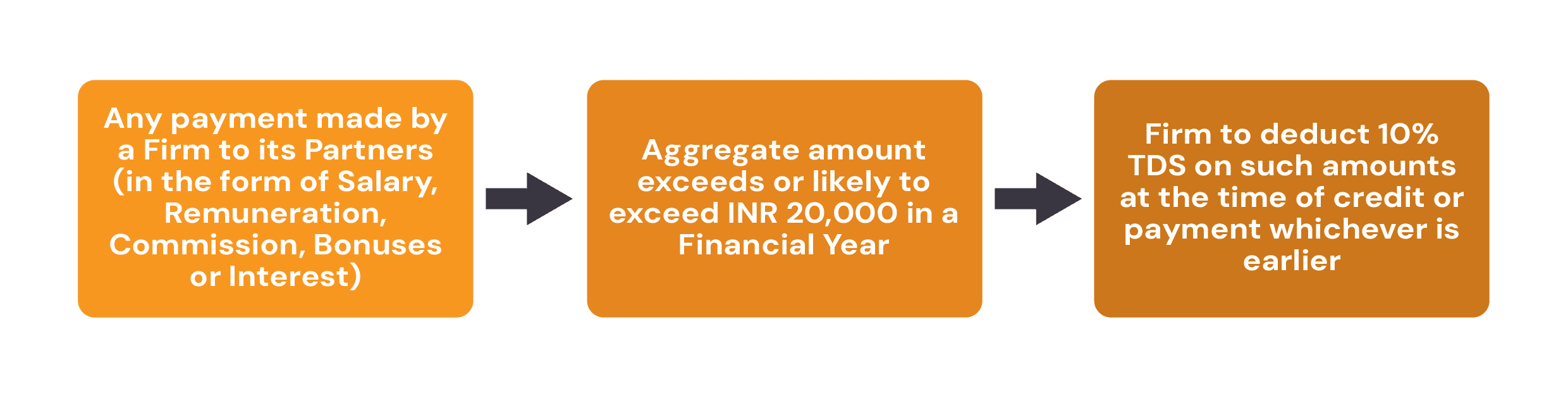

Section 194T of the Income Tax Act 1961 entails a new Tax Deducted at Source (TDS) provision on the payments made to partners of partnership firms and LLPs. Payments in the form of salary, remuneration, commission, bonuses or interest made by a firm to its partners, and such payments, if exceeding INR 20,000 in a financial year, will attract TDS at a rate of 10%. This provision will come into effect from April 1, 2025. The intention is to cover these payments under the TDS purview, as it was neither getting covered under Section 194H (TDS on commission) nor under Section 192 (TDS on salaries).

Introduction

Key Compliance Requirements Under Section 194T

Applicability: Effective from April 1, 2025. (Not applicable for FY 2024-25)

Deductor (Person Liable to Deduct TDS):

Any person being a Firm, which includes a Limited Liability Partnership (LLP) as well.

Does not include a foreign LLP.

Deductee (Person Subject to TDS)

Partners of a Partnership Firm or an LLP.

Includes both working and non-working partners.

Includes a minor partner admitted to the benefit of the partnership.

Time of deduction: At the time of crediting such amounts to the partner’s account (including the capital account) or at the time of actual payment, whichever is earlier.

TDS rate:

10% in normal cases.

In absence of PAN or Aadhaar details from the partner, TDS will be deducted at 20%.

Issuing TDS Certificate: The Firms and LLPs must ensure to issue Form 16A to the partners who come under the purview of Section 194T.

TDS Return Filing: The deducted TDS must be deposited with the government and reported through quarterly TDS returns.

Obtaining Exemption Certificates:

Partners of a firm or LLP cannot obtain lower or nil deduction certificates under Section 197.

Submission of Form 15G/15H for exemption from TDS is also not permitted.

Non-Resident Partners: Deduction for non-resident partners needs a deeper evaluation of the provisions.

Consequences of Non-Compliance

Firms comply with Section 194T, and failure to timely deduct or deposit the TDS may lead to regulatory compliance issues, which include:

Disallowance of expenses under Section 40 of the Income Tax Act, increasing the taxable income for the firm.

Interest and penalties for delays in depositing TDS amounts and filing returns.

Potential prosecution under the Income Tax Act.

Conclusion

The changes brought in with the introduction of Section 194T now require regular compliance in the hands of the firms. It is imperative for the firms to work in advance by maintaining and modifying (if required) the accounting system while notifying the partners and ensuring compliance from April 1, 2025.