Key Parameters for Recognizing Intangible Assets

Intangible assets are the assets of a business or an individual that lack physical substance in their existence but are crucial for its smooth functioning and can generate revenue and future profitability for the business. Unlike tangible assets such as buildings, machinery, or inventory, these assets are typically devoid of any physical presence but are identifiable and play a significant role in the operational management of the entity. Common examples of intangible assets include Patents, Trademarks, Copyrights, Software, Customer Database, etc.

Recognition of Intangible Assets

There are various criteria based on which intangible assets can be recognized and valued. These are defined under IAS 38 under IFRS and AS 26 of IGAAP.

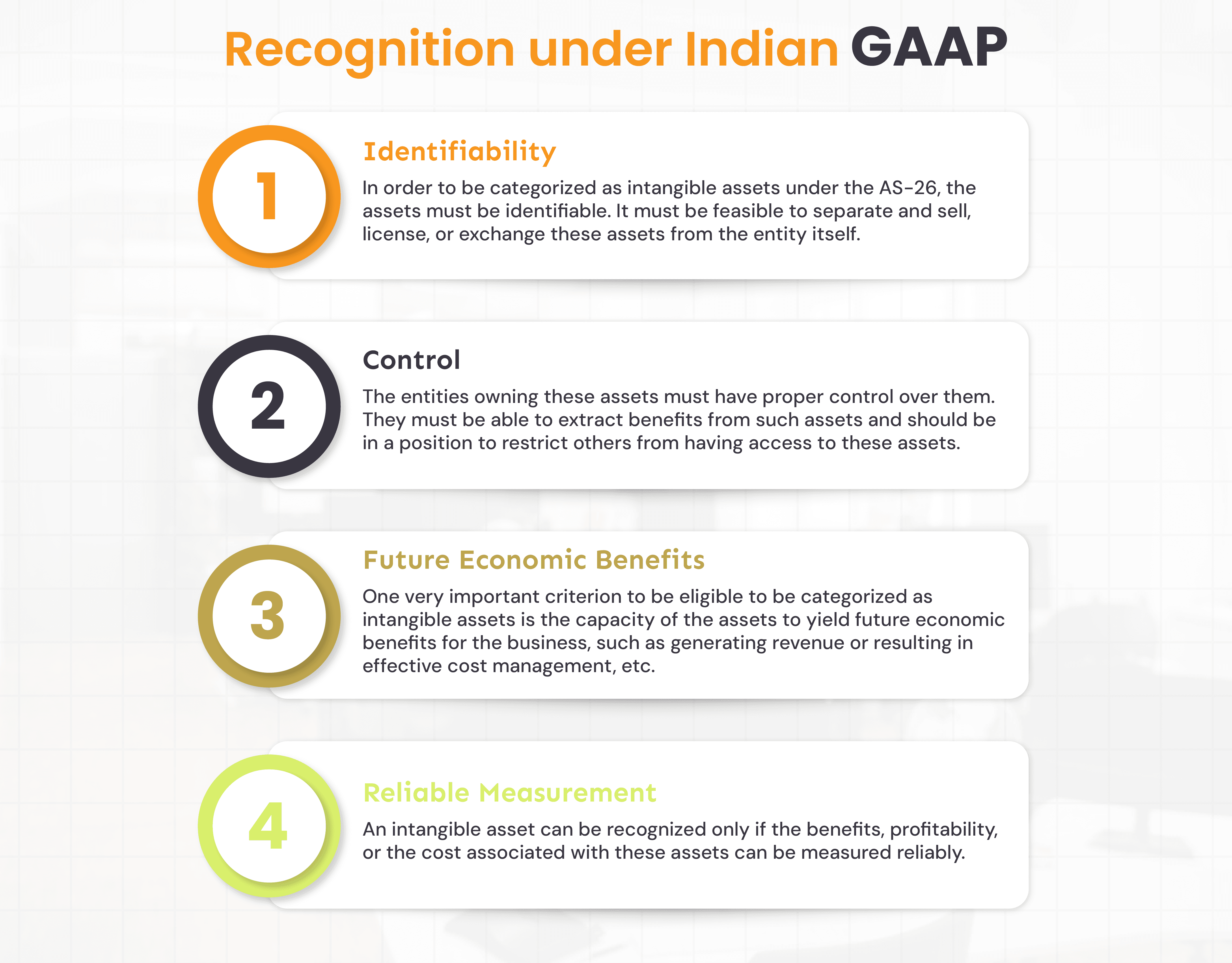

Recognition under Indian GAAP

The recognition of intangible assets under the Indian GAAP (Generally Accepted Accounting Principles) follows the guidelines provided in Accounting Standard (AS) 26 - Intangible Assets for recognizing intangible assets. Let us have a look at the parameters for the recognition of intangible assets under the AS-26:

Exclusions under Indian GAAP

There are certain categories of assets that can’t be recognized as intangible assets under the Indian GAAP, such as:

intangible assets held by an enterprise for sale in the ordinary course of business

deferred tax assets

leases that fall within the scope of AS 19, Leases; and

goodwill arising on an amalgamation (as in AS 14, Accounting for Amalgamations) and goodwill arising on consolidation (as in AS 21, Consolidated Financial Statements).

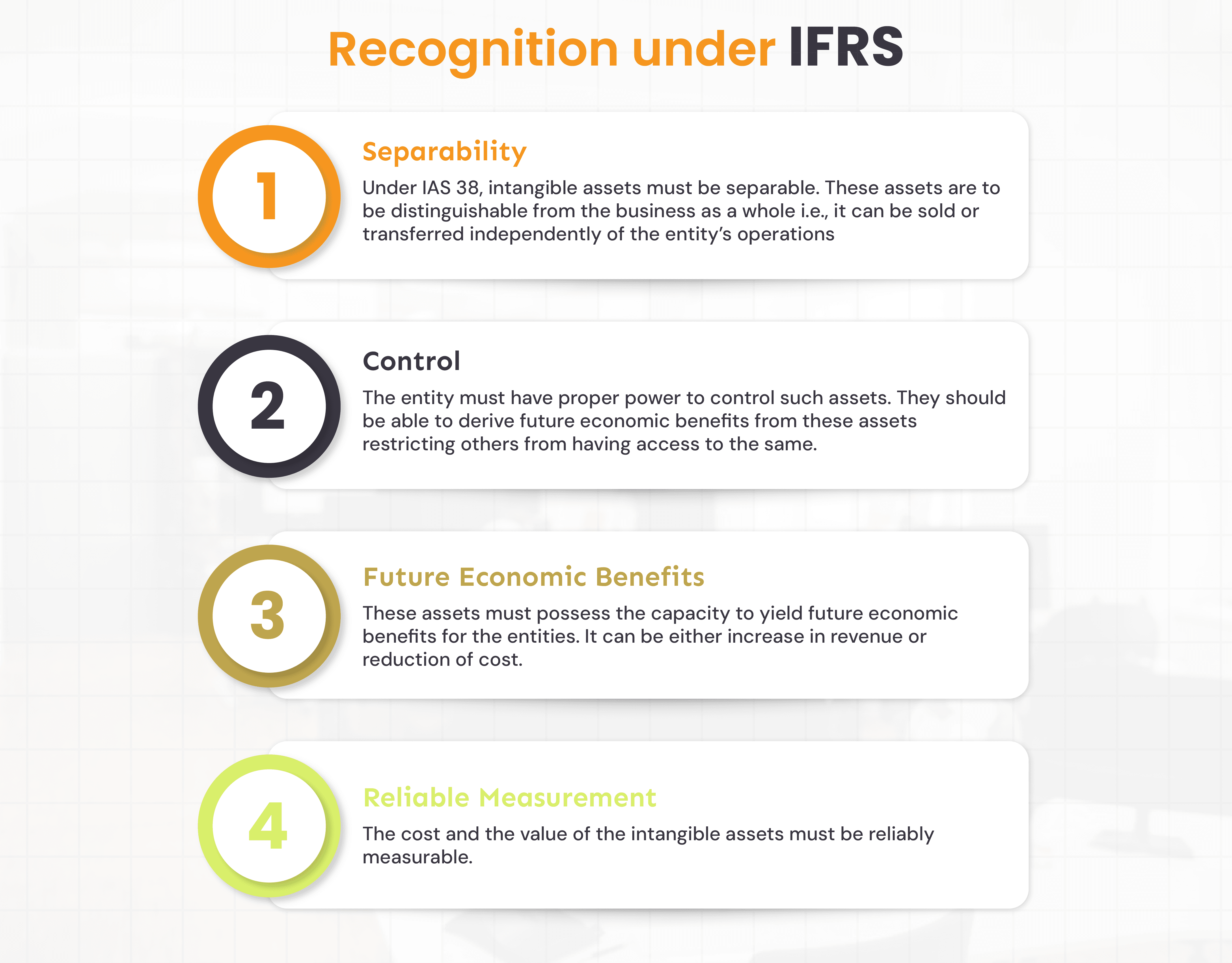

Recognition under IFRS

Under the International Financial Reporting Standards (IFRS), the recognition of intangible assets is guided by IAS 38 – Intangible Assets. The parameters include:

Exclusions under IFRS

IAS-38 provides certain restrictions with respect to the recognition of intangible assets such as prohibiting the recognition of self-generated goodwill or brands, training, advertising and promotional cost, certain research and development cost. However, based on some criteria, development cost can be capitalized.

Goodwill: Self-Generated vs. Purchased

Goodwill is a unique form of intangible asset, either internally generated or arising from the acquisition of another company. The two types of goodwill are:

Self-Generated Goodwill

The self-generated goodwill is the result of internal efforts to build the company's reputation, brand, customer loyalty, and competitive advantages. It is generally not recognized on the balance sheet, as it cannot be independently measured and valued reliably and hence cannot be specifically termed as an intangible asset.

Purchased Goodwill

The purchased goodwill is the goodwill that arises when a company acquires another business for a price higher than the fair value of its identifiable assets and liabilities. The difference between the acquisition cost and the fair value of net assets acquired is recognized as purchased goodwill. The purchased goodwill is recognized as an intangible asset and is entered into the balance sheet at its fair value at the time of the acquisition.

Measurement of Intangible Assets

Measuring the intangible assets is a critical process, especially due to the lack of physical substances in it. But it’s an important part of financial reporting and also crucial for strategic decision-making. Some common methods of measurement of intangible assets include:

Cost Method: Cost method takes into consideration the costs incurred in acquiring or in the generation of the intangible assets as the key parameter to measure these assets. Costs such as developmental expenses, legal expenses or registration costs are considered for measurement in this method. Intangible assets such as patents or copyrights are often measured by this method.

Market Method: Intangible assets such as trademarks or licenses, are often measured by this method where the value of these assets is determined by comparing them to similar assets that are in circulation in the market. The valuation of similar intangible assets which have already been sold or licensed helps in estimating the asset’s comparable worth in the active market.

Income Method: In this method, the intangible assets are valued on the basis of their ability to generate future economic benefits. The method projects the future cash flows expected to be generated from these assets and discounts them to the present value. This approach is very useful in the valuation of customer databases and proprietary software.

Relief-from-Royalty Method: This method estimates the value of intangible assets by calculating the royalties an entity had to pay if it did not own that particular asset. It is often used for patents or trademarks.

Amortisation

Amortisation plays a crucial role in the measurement of intangible assets, especially in accounting for their cost over time. Unlike physical assets, which may depreciate, intangible assets often have a finite useful life, and amortisation allows businesses to allocate the cost of these assets over their expected period of benefit. This process is generally performed by using a straight-line method, where the cost of the intangible asset is evenly spread over its useful life. For example, patents, copyrights, and trademarks may be amortised annually until their legal or economic value diminishes. However Intangible assets that have indefinite useful life are not amortised but are subject to annual impairment testing. Both amortisation as well as impairment help in ensuring that the carrying value of intangible assets on the balance sheet reflects their declining value over time, providing a clearer financial picture. Also, the amortisation expense is deducted from revenue, which can have tax benefits for businesses holding intangible assets.

The Key Principles Followed in the Process of Recognition

Reliability of measurement and the capacity to yield future economic benefits are the two major criteria for recognition of intangible assets: both under the Indian GAAP and IFRS. However, the timings and the method of measurement vary in these two standards.

Under Indian GAAP (AS 28)

Permits recognition of intangible assets if their cost can be reliably measured, with particular focus on assets such as patents, trademarks, and copyrights. Intangible assets like goodwill are not recognized unless purchased through an acquisition.

Under IFRS (IAS 36)

Allows the capitalization of development costs if the future economic benefits can be reliably measured. It is stricter than Indian GAAP, where development costs may not always be capitalized.

Impairment of Intangibles

Impairment of an asset is the reduction in the carrying value of an asset, typically when the recoverable amount is less than the carrying amount. Intangible assets, being subjective in their valuation, are often subject to impairment scrutiny.

Under Indian GAAP (AS 28) and Under IFRS (IAS 36)

Impairment of assets under Accounting Standard (AS) 28 and IAS 36 both require an impairment test for intangible assets when there are indications that the asset’s carrying value may not be recoverable. An impairment loss is recognized when the asset’s recoverable amount (higher of fair value, less costs to sell or value in use) is lower than its carrying value.

Disclosure

Aspect | AS 26 | IAS 38 |

|---|---|---|

Useful Lives | Useful lives or amortisation rates used | Whether useful lives are finite or indefinite; if finite, specify useful lives or amortisation rates used |

Amortisation Methods | Methods used for amortizing | Method used for finite useful lives |

Gross Carrying Amount | Gross carrying amount and accumulated amortisation (with accumulated impairment losses) at beginning and end as per AS 26 | Gross carrying amount and accumulated amortisation (with accumulated impairment losses) at beginning and end as per IAS 3 |

Statement Line Items | Not explicitly required | Line item(s) in the statement of comprehensive income where amortisation is included |

Reconciliation of Changes | Reconciliation of carrying amount at the beginning and end of the period, including: | Reconciliation of carrying amount at the beginning and end of the period, including: |

- Additions (internal development or amalgamation) | - Additions (internal development, separate acquisition, or business combinations) | |

- Retirements and disposals | - Assets classified as held for sale or included in disposal groups under IFRS 5 | |

No disclosure for revaluation | - Increases/decreases from revaluations and impairment losses (recognized/reversed in profit or OCI) in accordance with IAS 36 (if any) | |

- Amortisation recognized during the period | - Amortisation recognized during the period | |

Impairment losses recognized or reversed in profit and loss | impairment losses recognised or Reversed in profit or loss during the period in accordance with IAS 36 | |

NA | - Net exchange differences arising on the translation of the financial statements into the presentation currency, and on the translation of a foreign operation into the presentation currency of the entity; | |

Other changes in the carrying amount during the period | Other changes in the carrying amount during the period |

Conclusion

Recognizing the intangible assets is crucial for ascertaining the future economic growth of a business entity and it requires a thorough understanding of the unique characteristics such assets possess. The contribution of these assets to the future profitability of the company is a key factor in it. The recognition and measurement of intangible assets under both: the Indian GAAP and the IFRS use similar foundations but differ significantly in treatment particularly with respect to research and development costs, goodwill, and impairment. Following the appropriate standards and guidelines, businesses can ensure compliance with respect to financial reporting and enable the business leadership to take informed decisions on future strategies related to profitability and revenue generation.

Contributors

Ekta Kukreja linkedin

Rakshitha Prabhu linkedin

Kuldeep Sarma linkedin

Poonam Vernekar linkedin