Joint Development Agreement (JDA): A Comprehensive Guide to Its Implications on Indian Real Estate

A Joint Development Agreement (JDA) is a mutual arrangement between landowner(s) and developer(s) where the landowner gives his/her land to the developer without transferring the ownership of it. The developer/builder builds residential or commercial spaces on that land and takes care of everything like marketing the property, getting legal permission, registering the flats in the buyer's name, etc.

Once the property is built, the landowner will get a certain number of residential or commercial units as agreed upon or a share of the money earned by selling the units. This is quite like a barter arrangement. This arrangement also works in a way that upon completion of the project, the profits are shared mutually by both the parties based on the terms agreed upon in the agreement.

Benefits of Joint Development Agreements

In countries like India where affordable housing and sustainable living has been an ongoing concern especially in the urban settlements; entering into JDAs is a widely preferred option for developing profitable and viable housing or commercial projects for the huge middle-income customer base that the real estate sector has got.

JDAs have become hugely popular in India with the recent tax reforms initiated by the Government by introducing Section 45(5A) of The Income Tax Act.

These agreements have enabled

Landowners to capitalize on the future potential of their properties without having to undertake the development process or possess the necessary expertise.

Developers gain access to prime real estate, fostering a mutually beneficial arrangement that optimizes both financial returns and real estate opportunities.

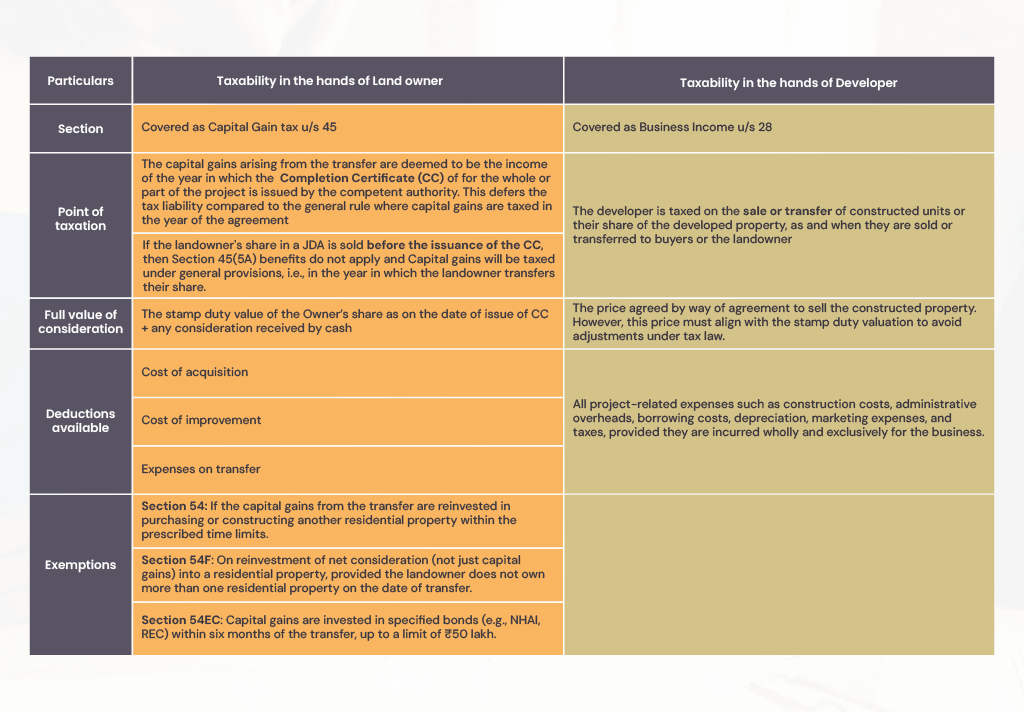

Taxability of Income Arising from JDAs In India

Section 45 of The Income-tax Act, 1961, governs the general capital gains tax in India. In JDA’s, this triggers tax liability for landowners when possession of the property is handed over to the developers. To alleviate this financial burden on individuals as well as on the HUF landowners, Section 45(5A) was introduced in the year 2017 which defers tax for individuals and HUFs until the project's completion certificate is issued. The stamp duty value of the owner's share, plus monetary consideration, is treated as the full value of consideration. Section 194-IC mandates 10% TDS on monetary payments. These provisions are applicable from April 1st, 2018.

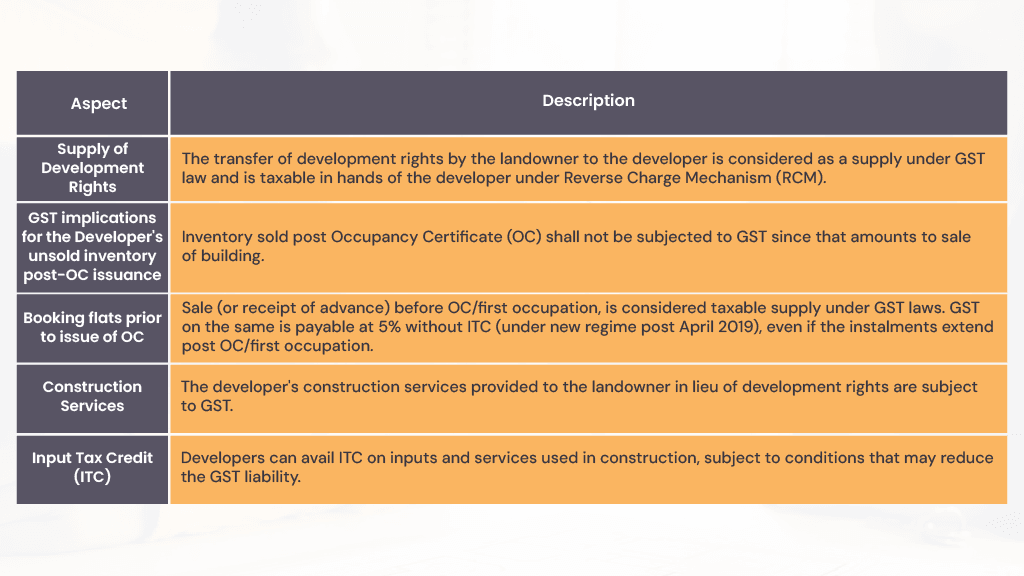

GST Implications on JDA

Let’s have a quick look at various GST (Goods and Services Tax) implications on Joint Development Agreements:

Conclusion

Joint Development Agreements serve as one of the most suitable and viable mechanisms for sustainable collaborations in real estate development. It offers various benefits such as maximum optimization of land resources, a better risk mitigation strategy and the potential for high returns. However, JDAs require careful drafting, a clear understanding by both the parties on its tax implications, and careful investment portfolio management to ensure a successful outcome. Engaging with legal and financial experts is advisable to navigate the complexities associated with JDAs effectively.

Contributors

Ekta Kukreja linkedin

Sindhushree M linkedin

Kuldeep Sarma linkedin

Poonam Vernekar linkedin