Tax Deducted at Source under Income Tax Act

1. Introduction

The concept of Tax Deducted at Source (TDS) or Withholding taxes as it is internationally called, was introduced as a part of Income tax Act, 1961 (the Act) with the purpose to collect tax from the very source of income. It requires that the person or organization on whom the responsibility has been cast called as Deductor, to deduct tax at the appropriate rates from payments of specific nature which are being made to the specific recipient called Deductee.

TDS is based on a concept called pay as you earn, where the deductor deducts an equitable amount of tax periodically on the earnings or income of the tax payer and remits into the account of the Central Government which practically assist the taxpayer from the burden of making a lumpsum payment at the end of the financial year. The deductee from whose income, tax has been deducted at source would be entitled to get credit of the said amount on the basis of TDS certificate issued by the deductor.

Payments of TDS constitute a substantial portion of the government’s tax collection, and the same is estimated to be over 42.45% of such collection (As given in the Annual report of 2016-17 as given by the Finance Ministry of India). TDS distributes the incidence of tax for a taxpayer and provides for a simple mode of payment. It also prevents avoidance or evasion of tax thus ensuring a regular flow of revenue for the government.

1.1 Applicability of TDS provisions

The Act provides for two broad framework for deduction of taxes:

a) Some payments made to residents in India have been prescribed to be subjected to withholding, for which thresholds and rates have been prescribed under Chapter XVII- B of the Act. A detailed list of rates as applicable for the current financial year is available here https://www.incometaxindia.gov.in/Pages/Deposit_TDS_TCS.aspx.

b) All payments to non-residents if they are taxable in India have to be subjected to withholding taxes at rates applicable for such non-resident

If however, the deductee fails to furnish the PAN to the deductor, the rate of TDS will be 20% or rate specified under the Act or rate in force, whichever is higher. In the case of non-resident deductees having no PAN, if they provide the information mentioned under rule 37BC including a Tax Residency Certificate (TRC) from the country of their residence, there is a relaxation for them from higher rate of deduction.

All such persons who are required to withhold taxes, are supposed to get a number called Tax deduction Account Number (TAN) and using the TAN all the compliances regarding TDS have to be done.

1.2.Non applicability of TDS on certain payments

Section 196 of the Act provides that no deduction of tax shall be made by any person from any sums payable to the Government, Reserve Bank of India, a corporation established by or under a Central Act which is under any law for the time being in force exempt from income tax on its income or a mutual fund specified under section 10(23D).

2. Compliances w.r.t to TDS provisions

2.1.Prescribed Time for Payment of TDS and mode of payment

Once TDS is deducted, the deductor must remit the same to the credit of Government of India within timeline that are prescribed as under:

- For deductions made in the month of April to February of every year - on or before 7days from the month in which tax is deducted.

- For TDS made in March - within is 30th April.

The payment of withheld taxes is to be done using the following forms:

a) For TDS on payments made on selling an immovable property – A combined challan-cum-return by name Form 26QB

b) For all other forms of TDS (resident or non-resident) – Challan No.281

The payments can be either made in designated banks using the above challan or can be paid online from www.tin-nsdl.com using internet banking.

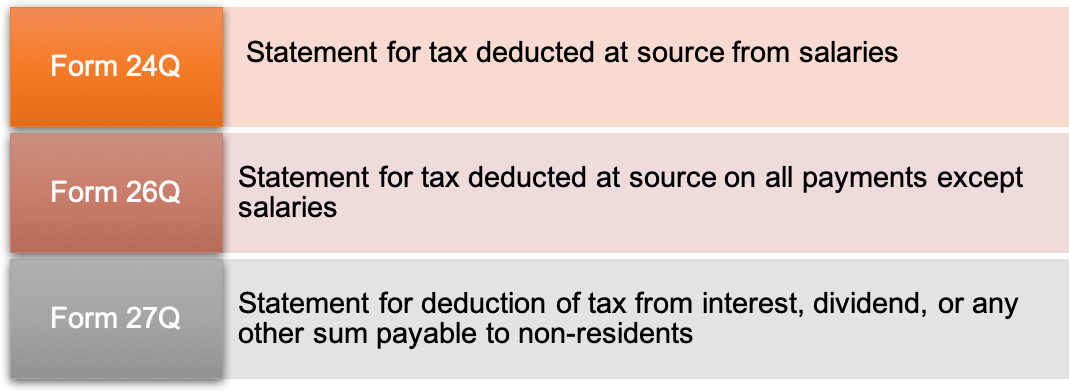

2.2.TDS Returns and Forms

Once the withheld taxes are paid to the Government, the due credit has to be passed on to the deductee, such passing on has to be done by filing an electronic TDS return. Such returns are to be filed on a quarterly basis. The forms prescribed for the filing are as under:

The prescribed due date for filing of TDS returns is the last day of the month subsequent to the quarter in which returns are due. For ex: for April-June the due date is 31st July and so on.

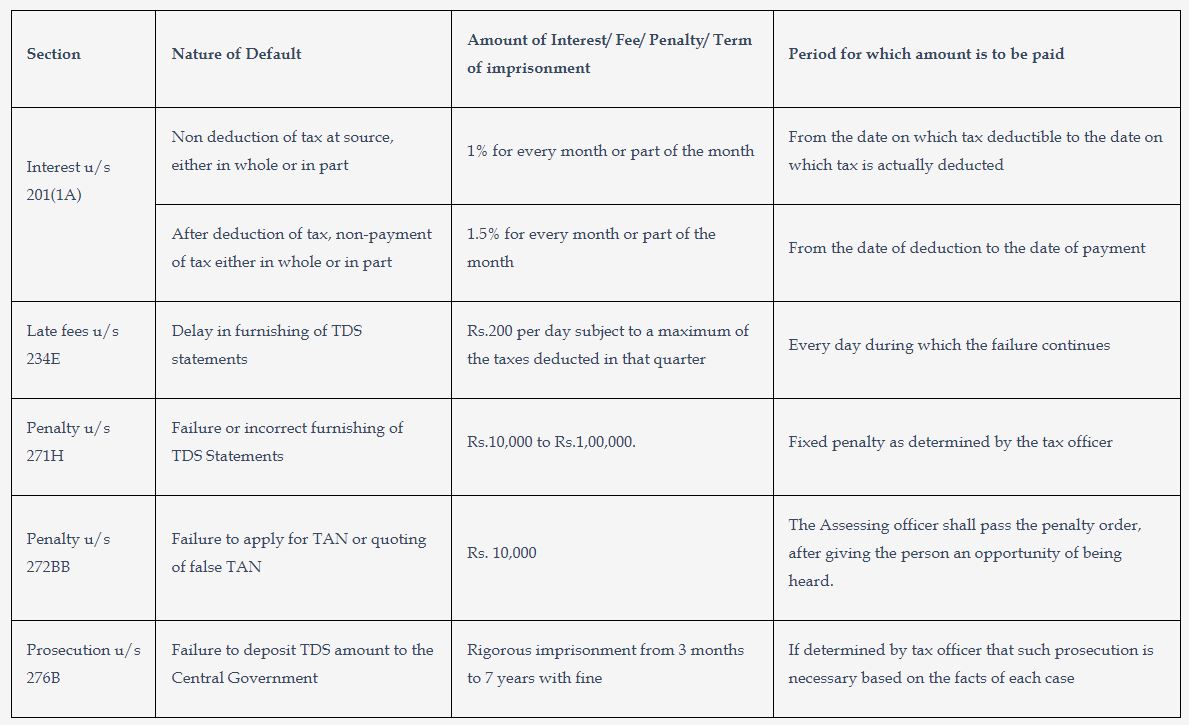

3. Consequences of Non – Compliances with TDS provisions

Following table provides the details of consequences for default in compliances with TDS provisions:

4. Conclusion

TDS provisions are a very integral part of compliance under the Income Tax law in India. It acts as a regular source of income for the Government and would also act as a reporting mechanism for incomes earned by various sections of people, thereby making the tax administration simpler. Further, the consequence of not complying with it are rigorous and all those who are cast with the responsibility for deduction and remittance cannot ignore the same. It is also recommended that a proper control mechanism is built by each business entity to ensure that the TDS provisions are suitably complied.